The characteristic of our program is the lack of need to be widely aware of accounting or be technically good .. But it is sufficient to distinguish the debtor party from the creditor or the party giving the recipient, where each account nature Either to be debtors and when the balance increases or amount must be at the right (debtor) of the restriction and vice versa.

This distinction is not difficult. For example, the account of the Fund is of a city nature. Therefore, when an amount is entered into the Fund, the Fund is established in the debtor’s party of the contract and thus it is the first party (the first condition) However, if the fund is an impulse, any amount that comes out of it is first of a kind of city, and secondly it is the mu’ti, not the beneficiary, and therefore it must be placed on the left side of the loan. We can drop this situation on any account.

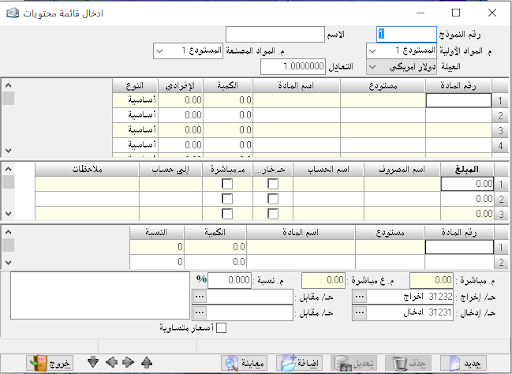

Two (theoretical) sections: accounting department, consisting of (constraints, balances and accounts) and a related section And is called and (materials, warehouses), and invoices between accounting and warehouses and the important thing is the link between the accounting and warehouse in it.

Where we prove when the movement has a substance or group of substances we are enough to prove that the nature of the bill by the movement

And automatically after storage we see the accounting restrictions that will control this movement computationally and accounting

.

Learning Lessons

Explanation of program lists

Every transaction in actual whether small or big must have an accounting record, in other words, every transaction must be proven to reach an accurate and orderly work. This proof is called a daily entry, as every transaction must have a daily entry to prove it.For example, if we paid SYP 500, this transaction must be proven by the following entry: 500Debit: Shipping expenses500Credit: CashPayment of shipping expensesAnd that’s when the payment is in cash. The special thing in accounting programs in general and in our program, in particular, is that the accounting entry is recorded for each transaction automatically without the need to type a full accounting entry, except rare and few cases depending on the situation.So, each invoice automatically generate its special entry and post it to its special ledger accounts.

Create a simple entry:

A simple entry is an accounting entry in which just one account is debited and one is credited with a description, so it has no more than two parties.

– Entry number:

it is arranged automatically according to the sequence of operations in various forms.

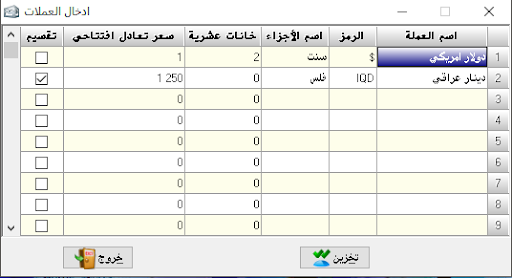

– Date: it is the date of writing or proving the entry.- Currency: the currency in which we want to prove the entry and its rate must be pre

-determined for the Syrian pound through the rate equivalent

.- Equivalent rate: it’s the rate of chosen currency against Syrian pound.- Debit account: it’s the first party of the entry (Debit).

– Credit account: it’s the second party of the entry (Credit)The debit and credit accounts can be determined by the original nature of the account and then by the case where the account is taken or given.

– Amount: the value of the entry or the amount of the accounting transaction.- Document: it’s the original paper document number, for the purpose of linking the original document to the accounting program.

– Description: is the explanation that should be mentioned in the entry to clarify it.The red arrows at the bottom of the entry were explained earlier in the invoice show section.

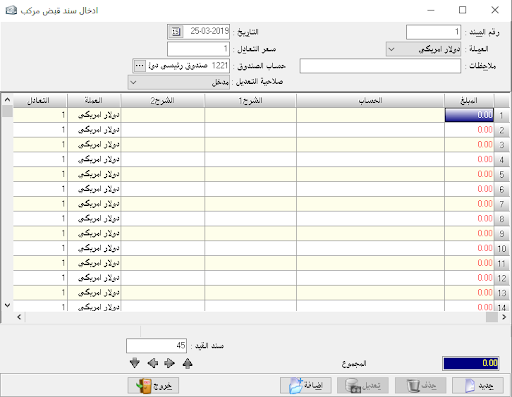

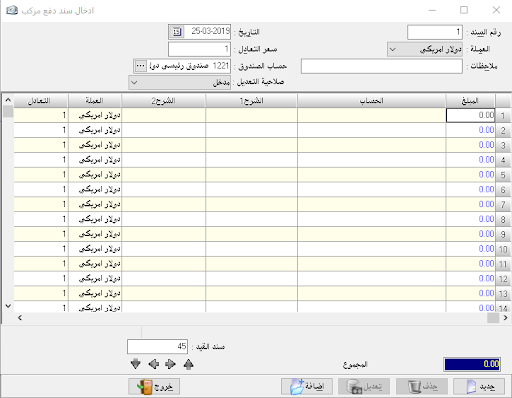

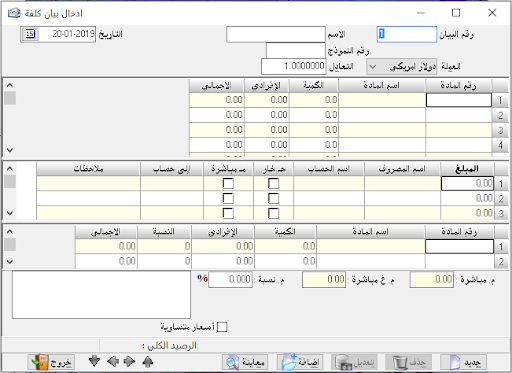

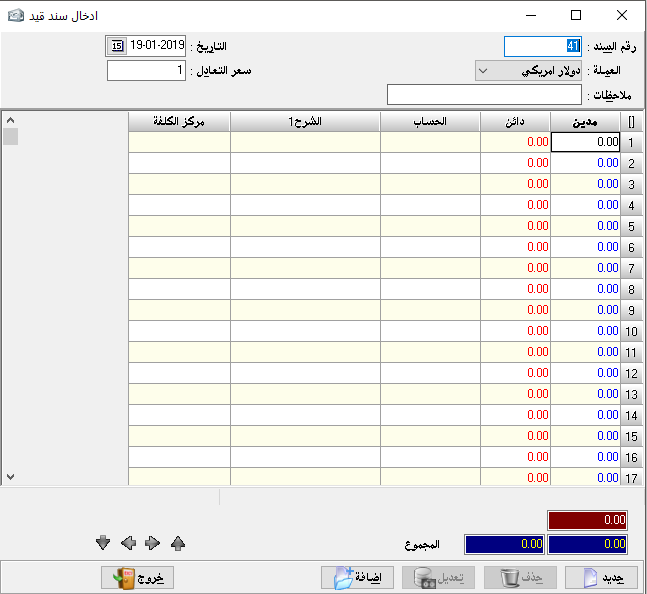

insert accounting entry:

It is the entry that the debtor or creditor can have a set of accounts (more than one account for each party). For example, if we want to prove payment and expense on a particular invoice we cannot prove it by a simple entry but there must be a complex journal entry because there is more than one party and of course this entry is automatically created.

– Currency: it is must be chosen to create an entry by that currency.

– Equivalent rate: it’s the rate of chosen currency against Syrian pound.- Notes: We may mention the document number related to the complex journal entry.

– Date: the date of the entry.

– Debit: where we type the amount related to debit party and in front of each debit account.

– Credit: where we type the amount related to credit party and in front of each credit account.

The account: where we type the account name whether it is debtor or creditor, while which determine its nature is the opposite amount if it was typed in the debit cell so the account must be debit, and if it was typed in the credit cell the account must be credit

– Document: it’s the original paper document number, for the purpose of linking the original document to the accounting program.

– Description 1: it is to explain the purpose of the entry and the transaction.

– Description 2: Additional explanation about the transaction.

– Currency: We can choose a currency for each line and we can create an entry with more than 99 currencies, and this option appears with additional options by double-clicking on the small rectangle above number (1) and beside the word Debit

.- Equivalent rate: it’s the rate of chosen currency against Syrian pound.

– The second party: Its use is rather special, it is used to prove the account of the special transaction that made on a particular material and that if we have singled out a special account for each material to control its movement independently, for example, shirts sales account and trousers sales account.

Also, used when creating a complex entry where it usually appears in the second end of the entry when you request to show the account statement of word others. The second party here is used to put the opposite account to mention this account instead of the word “Others”.

– Local: Used if we wish not to show a specific entry when we request an account statement for any account but not the original currency where the amounts of all entries are transferred to the foreign currency except the local entry, which is greatly beneficial in entries of the foreign currency exchange differences.

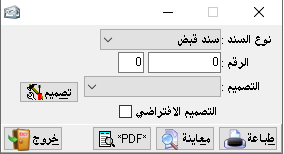

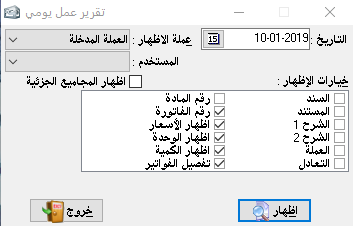

Show entries:

This section is used primarily for displaying all or some entries that are recorded manually or automatically. These entries can be shown by date or number.

And we can use it to print entries periodically if we want to keep an archive about them or when the system of the organization requires the printing of the journal entries or entries in general.- Show entries by:

1- Date: where it arranged according to its chronology.

2- Number: where it arranged according to its numerical sequence.- show options: as follows:

– Entry: and it’s the number of entry which was created in the program.

– Document: it’s the original paper document number, for the purpose of linking the original document to the accounting program.

– Description 1: it is to explain the purpose of the entry and the transaction.

– Description 2: Additional explanation about the transaction.

– Currency: where the currency in which the entry is created appears along with this entry.

– Equivalent rate: it shows the currency in which the entry was created against the primary currency.

It can be activated by choosing showing currency option (entry currency).

– Showing currency:

Where we can show all documents in a particular selected currency or show them each according to the currency in which the transactions were created.

– Show subtotals: it means to show the sum of each complex entry under the sections of this entry, but if the entry is simple it does not belong to it.

– Show opening entry: it is the entry that was written at the beginning of using the program in order to configure the opening balance sheet.

It is automatically created by inserting the rounded balances into accounts cards and materials cards, or the opening entry can be created first, therefore these items are automatically transferred to the rounded balance on each card.

Advanced options:

It will make it easier for us to find a particular entry that we want to show or make sure if it was created.

– Description 1:

It is enough to type a part of any word that was mentioned in the first entry description, to show all entries that share this word in the description 1 section.

– Description 2:

it is the same as description 1.

– Document: It is enough to type the original document number that mentioned in the entry to show it solely.

– Equivalent: it is enough to type the particular equivalent rate related to currency to show us all entries that prove the currency equals the related rate against Syrian pound.

– Credit account:

where we type the credit party of the entry and the program will search for all entries where that account appears as a credit party.

– Debit account: the same definition as the credit account but with different terms.

– Amount: we can search for a particular entry by its amount by typing the amount here.

– Search within invoices: here the program search for particular detail within invoices only or more accurately within invoices entries only.Note: Among the mentioned, to search for a specific entry we can collect all searching options together. For example, we can type (Payment) in description 1, Document (300), amount (40000), credit account (Sameer)… and all those filters will find a specific entry so we can reach the wanted entry by many options.

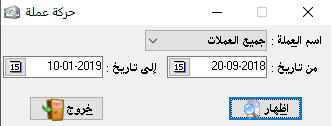

– Currency:

we can search for entries using one specific currency.

Cash movement:It is considered one of the most important and most used sections in the program and it is very vital, saves us a great effort and time, and reduces the possibility of error in writing the cash entries especially to zero (i.e., which related to cash account)It is sufficient to mention the cash transaction that has taken place as if it is outward or inward the cash and the program will create the necessary accounting entry and this section can be used with any accountand it is enough to change the account number to the wanted account.- Date: it is the date of transactions.

– Automatic save: it means storing the transaction without confirming it.

– Show the rounded balance: it means to show the account balance from the previous day (we will use this section as an example in cash account because it is the most important application).

– Show transactions of a specific day: it is to show all journal entries that were created on a specific day, and this for transactions not related to cash

.We can get additional options by double-clicking on the rectangle that is located above the number (1) and beside the inward field.

– Inward: it shows the rounded balance and all amounts entered the cash.

– Outward: it shows the rounded balance if it is credit and all outward amounts at the same date chosen up.

– Receivables: it appears when we choose to show today transactions, and it includes amounts of recorded entries which not related to the cash account.

– The account: it is where mentioned the receiver account (when the case is payment), for example (100) SYP in outward and in account name we type the account of petty cash expenses that is we paid 100 SYP for petty cash and we can explain it in the description section.

– Document: it is the original paper document related to this transaction, and here the most used is the receipt number.

So, when we prove payments from customers and to suppliers it is easier for us to create it using cash movement because we have to write only one part of the entry, so we can prove the receipt number directly in the document field, and the program will complete the entry and store it by case.

– Description 1: to explain the written transaction.

– Description 2: for an additional explanation about the transaction.

– Currency: we can use any currency while creating cash movement as creating accounting entries.

– Equivalent rate: it is the equivalent rate against the Syrian pound for each transaction.

– Red rectangle at the bottom if on the right indicates the debit balance of the cash account (the amount remains in cash after posting all transactions), and if on the left indicates the credit balance of the cash account (i.e. we paid more than the amount available in the cash and this requires checking for it).While the first and the second blue rectangle shows the total debit and credit of transactions. The third rectangle shows the sum of receivables transactions and appears only when you choose to show today’s transactions.

– Entry number: (and it appears at the bottom of the table) means the accounting entry number that was written, and the numbering is automatically generated to prove the transaction.So briefly this section can be used as a journal entry or cash book exactly.

In the inward field, we write the amount received and in the description, we write the name of the account which paid to us, in the outward field we write the amount paid and the description is the name of the beneficiary account. For more explanation try to write a payment from customer number 1 for example then choose to show entries, and you will find the following entry: Debit: CashCredit: Customer number 1DescriptionTo delete a particular transaction in the cash movement you must know the entry number from the bottom of the page then go to the section of creating an entry and choose the entry number to delete it then choose delete.Note: in cash movement, you can move between the previous day and the later day by using Ctrl+Pageup to go to the previous day and Ctrl+Pagedown to go to the later day.

accounting entry:

It is almost like the cash movement, but it can beused for any account more easily.

– Account number: we choose here the name or number of the account we want to post all entries on it. So it is the other party of the entry whether it is debit or credit.

This is shown in the inward and outward fields and there is a very important difference, which is the date where we can write the transaction at any date we want while the cash movement is restricted by a specific date or we have to move between days within the cash movement.

– Inward: we write her the amount representing the credit party of the entry where the account we have chosen at the top is the debit party of the entry. i.e. the opposite of the cash movement.

– Outward: we write here the amount representing the debit party of the entry where the account we choose is the credit party of the entry.

– The account: it is the other party of the entry and can be known by location of the amount in the field inward or outward.

– Document: it’s the original paper document number, for the purpose of linking the original document to the accounting program.

– Description 1: it is to explain the purpose of the entry and the transaction.

– Description 2: Additional explanation about the transaction.

– Currency: it can be activated when we have more than one currency within the program.- Equivalent rate: it is the rate of the chosen currency against the Syrian pound.

– Date: we can choose various dates for each line

– The red rectangle, the two blue rectangles, and the document number are the same as what explained in the cash movement about it.

– Delete: to directly delete a specific entry without back to the section of creating an entry to delete it.

exchange rate differences entries:

If the organization has transactions in foreign currencies, and as a result of changing in foreign currencies rates, there must be differences between the balance of the foreign currency and its value in the Syrian pound.

Therefore, a special account must be created in the chart of accounts to prove the differences in foreign exchange.

The task of this section is to make a continuous comparison between the balance of foreign currencies and the exchange rates entered and then to calculate their value in Syrian pounds and to prove the differences in the respective accounts.

Here we create a debit exchange differences account and credit one, or we can use one account for both cases.

In the exchange rate button, we enter the rate of each currency as a basic rate of comparison, and of course, the rate of the currency must be at the moment when we calculate those differences.End:Use it to exit from the program.

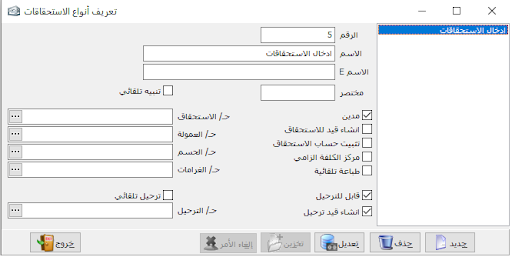

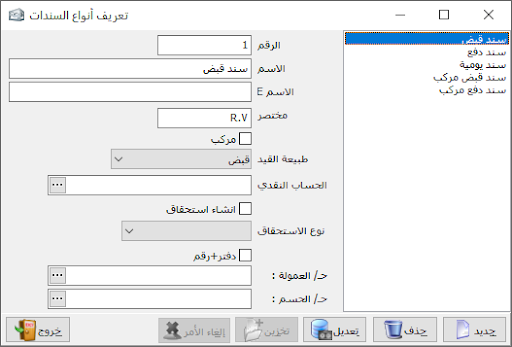

Create/correction of account:

The task of this section is to characterize or define the necessary accounts to build our chart of accounts, where the chart of accounts is based on the principle of grandfather, father, and son.

There must be a primary master account then a secondary master account which will be divided into sub-accounts.

And another master accounts can be divided from the secondary master account as needed.

It is preferable to start with the number (1) and to name it the general assets which is a master account.Account number:

write in the account number (1)Account name:

write it general assets.Account type:

choose it master.Origin:

it means with which this account is linked to or which is the original or top-level account of it. (in our example there is no origin because it is the original account)Posting: where it should be closed and in which closing account should be posted.

We can choose (Balance sheet).(Address, notes) there is no accounting impact related to this section, but for more explanation.

Group: it means this account for which qualitative account belongs and the qualitative account will be explained later.

Archive: it is a particular archive related to the client we can put here full details about the client in addition to his photograph or his identity photocopy.

Distributor: here we can put the name of the employee responsible for the client to link between their accounts together.

Commission: it is the amount of commission that calculated directly to be paid to the related distributor, and the distributor’s name appears automatically on the invoice as the linked customer’s name is chosen.

Rounded balance: it the current account balance (only if the account is sub-account this section will be activated) when we post our accounting books to the accounting program if the project is already in place.

It would create part of the opening balance of the project.

Debit balance: it shows the balance status when we return to the card later, and we cannot write in this field.Credit balance: it shows the balance status when we return to the card later, and we cannot write in this field.Current balance: it shows the balance status when we return to the card later, and we cannot write in this field.Title: it means the title placed in front of the account name for more tact showing like Mr. Mohammed Ahmed.Balance: it means the original nature of this account if it is debit, credit, or is fit for the both of them…

(all that are involved under assets and expense is deemed to be debit and all that are involved under liabilities and revenue always credit).

Level: to determine which users are allowed to deal with this account, whether it is primary or partially.

And in case of restricting a specific level, this account or its balance will not appear for this level, not by searching, reporting, or even by the chart of accounts.

You can also select either hide account only, hide transactions only, or show balance only.Discount ratio: the percentage taken by the customer specified on this card.

When you write any invoice, the program will read the price of the material from its card as predetermined and read the discount percentage and then the material will appear in the invoice by the price after discount automatically.

Special balances: used in order to link a group of accounts that related to each other (statistically) such as customers of a particular material or customers who make payments with a specific frequency (for example, on Thursday).

Or customers from a specific area or customers related to a specific employee who is responsible for them.

These balances are selected from program constants, then general constants, and then special balances field.

And after specifying it we go back to account card to put the special link related.

This will be explained in detail in later sections.Back to the example: number (1) is general assets.

– its type is master without origin.

– will be posted to balance sheet, and that’s all it takes.

About the first branch from it is number (11) for example fixed assets:

– its type is master also.

Its origin to number (1) and automatically appears the section of posting based on its origin account.And the first part of the first branch is the number (111) for example is buildings:

– Its type is sub-account.

– Its origin to the account number (11) and will be posted as its origin and we can insert a rounded balance on it and it’s always debit, and it’s not required to be classified under one of the special balances.

The second sub-account is (112) for example vehicles has the same specifics of the account (111).And about the second branch (12) for example current assets:

– Its type is master, and its origin to the account (1) and will be posted as its origin.

The first part of it is (121) for example customers:

– Its type is master.- Its origin to the account (12), and will branch from it the customer number (1)Then we will have the following card:When we want to add another customer, it’s enough to write in the number field the sub account number (1210) and then press on button F7 so automatically it will take the number (121002) and so on.

There is a third type of accounts, which is the qualitative account and it has great importance, through the qualitative account we can link a certain group of accounts whether these accounts of the same nature or different from each other but we have a purpose behind this linkage.

For example, we can link a particular revenue account to a specific expense account that might be the expense of this revenue.

So, when we request an account statement for this qualitative account, we will have the result of clearing between these two accounts, which are the qualitative account.

Or we may link two accounts related to one client may be a customer or a supplier and we want to know his net balance thus we can create a qualitative account, and it can be said that the first use of this qualitative account is the linking of accounts that share in certain properties and we want to see it together.

For example, maybe the investor has another activity and this activity is so small that it is not necessary to completely separate its accounts.

thus, he can create the accounts necessary for it in the existing chart of accounts and then defines a qualitative account in the name of this activity and linking all accounts of this activity and thus he will have a small balance sheet within his general balance sheet showing this activity separately from the rest of the accounts.

The real advantage of this feature is evident in the practical reality of each investor of the program and according to his system of work

We can now take a look at what we have done through show accounts section in the title of the accounts.

This section shows us the basis of our work, the chart of accounts.

When the chart of accounts is correct our beginning is correct. Hence, we can take several options by pressing the right mouse click when we stand on any account and this makes it easier for us to set up and continue the chart of account. (Note: in our example, we did not use the chart of accounts of the common accounting system for simplification first and because it is not fully used in all projects).In options item we can find:

– Show the closing account: it means to show where the account will be closed.

– Show sub-accounts: where sub-accounts appear under the primary account or secondary account.

– Show qualitative accounts: it means show qualitative accounts at the end of the chart of accounts.

And from the level section:We can find the level of the account we want to show, and if we choose all levels it means all accounts will appear.Under the section of show we can find:

– Show accounts: and this is where the chart of accounts is placed in a regular table, ready to print it this way.

– Preview: it’s used to review the chart of accounts before printing.

– Printing: to print the chart of accounts.

– Show the specific account: here we only show the chart of accounts of the main account we choose.

It is very important before we continue to prepare the program according to the nature of our activity that we take a thorough understanding of the way the chart of accounts is prepared and prepare it in a thoughtful manner.

The distributor of the program can be helpful simply and at every moment of preparation to take advantage of the accounting consultancy.

Opening entry:

Through this window, we can insert opening balances of all accounts (which defined in the chart of accounts) by placing the amounts in the debit or credit according to the balance, with the account name next to it.

opening entry is used at the beginning of using the accounting program to insert the opening balances and then start the accounting operations.

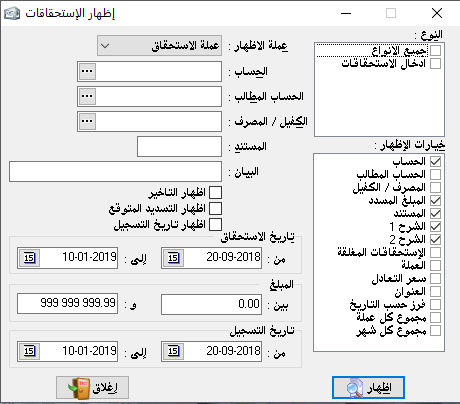

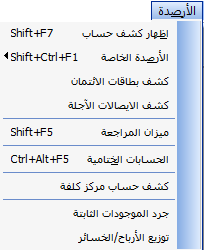

It is a statistical or reporting section in the program, as it shows the results of the previous entries mainly related to the accounts.

Show account statement:

It is a very important section in the program as it is widely used especially for matching and settlements with customers, every customer must ask us or send us a statement of account. All details of the customer’s account have been taken into account.

– Account number: we can choose one, all, or group of accounts that fall into one main account, one sub-account, or accounts that are selectively taken.

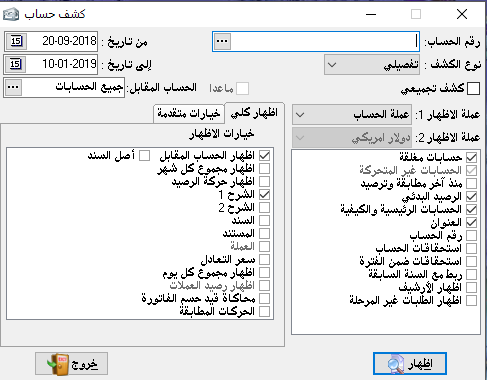

– Type of statement: here the show options at the left end are changeable by the type of statement you want as follows:

Detailed:

The most important thing that appears in it is the invoices but in an overall view, it does not appear within each invoice its details but the total value of the invoice, its number, and date. And we can note the following options:

– Show opposite account: it means the second part of the entry that written to prove a specific transaction with the selected account or accounts for which we have requested to show statements.

– Show the sum of each month: at the end of each month we show the sum of the debit transactions and the sum of credit transactions made on specific account during the required month.

This is useful for us to know the volume of our transactions per month with the selected account. And this may be useful in knowing the extent and viability of dealing with us in the coming period.

– Description 1 and 2: it is the comment added to the invoice in the notes section or to the accounting entry in the description section.

– Entry: it is the entry number that done in the program and on that account.

– Document: it’s the original paper document number, for the purpose of linking the original document to the accounting program.

– Currency: it can be activated when we have more than one currency within the program.

– Equivalent rate: it can be activated when we have more than one currency within the program.The options on the right side:

– Show closed accounts: it is accounts which its balances are zero when requesting its statement.

– Show non-moved accounts: any accounts which no invoice or entry has been written on it, therefore only the initial and the final balance will appear.

– Since the last match or settlement: here is the account that has been matched and proved in the field of matching balance from the miscellaneous section.

Or the account whose balance is zero where this account is automatically matched where this statement is shown from the date of this match.

– Show initial balance: show the rounded balance from the last year and when we don’t choose this option means that we want to disclose the transactions for this year only and without taking into account the initial balance of this account.

– Show primary and qualitative accounts: it means that when you select a statement for a primary or secondary account the primary account will appear with the total beside it and under it will appear the sub-accounts and partial accounts that are configured for the primary account. And if this option is selected, the accounts will be arranged on the basis of the account number and without another classification.

– Show address: it means the address of each account beside its name, and address is pre-written in the account card.

– Account number: account number in the chart of accounts beside his name. this option may not be used if we want to send a statement to a particular customer because it is not necessary to recognize the way our chart of accounts is.

– Maturity of account: it shows the maturity amounts that have been written on this account with disclosure as they are usually requested independently but here we can take them independently or merged with the statement of account.

– Maturity during the period: it shows all due amounts related to this period.

– link with the previous year: this feature allows us to extract any account statement that was for this financial year and for the previous year together and without having to close the files of this year and go to the files of the previous year to extract the statement.

Here you must locate the files on which the previous year data is located, and this is done from the section of the program constants then general constants.

– Show archive: it was written in the account card and represents the client’s self-image or his personal card image and its importance is considered an accurate reference to the address and phone numbers of the customer.

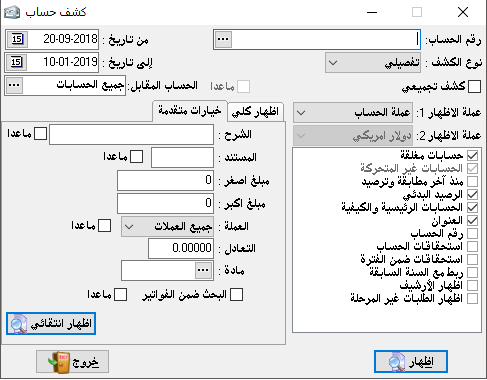

all of those previous options from the full show section under the detailed account statement and in the advanced options section we can have the highest possibility of searching:For example, if we want to search for an entry in which a particular word is mentioned (by Fouad) it is sufficient to write (by Fouad) in the explanatory section and then press show to show this entry in isolation from the rest of the entries.

And also in the same way we can search within the document or search for an invoice in which we mentioned a specific item, we write the name of this item within the field material.And if we want to know the entries in a particular currency and by which exchange rate, such as a dollar when the exchange rate was SYP 52.20.

so select the currency Dollar and the exchange rate is 52.2 then press show.

If we want to find a certain entry and we only know the amount, so we can limit all the entries or invoices which only contain this amount through the minimum and maximum amount option.

By all these options we can find the lost transaction or make sure about an entry that we were not sure if we posted in the correct position (like if we were sure about posting a transaction for a specific account, but we did not find it because we posted it wrong at the account of someone else.

So we can make sure about it by this advanced search).

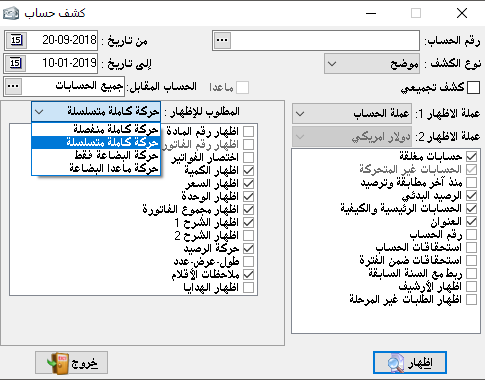

illustrative:

Here we can see a difference in display options available to show at the left end.

Here, we can show account details, the items of each invoice, and the appearance of a new box which is (required to be shown) and its details as follow:A separate complete transaction: it means showing all transactions made to this account in an illustrated way by the show options, but separately, the transaction of the goods first and then the entry transaction and without taking into account the dates in transactions.

Full sequential transaction: All transactions are shown in detail arranged by the date of each transaction and are similar to the detailed statement, but with a complete breakdown of the invoices and materials contained therein.Goods transactions only: it shows us the movement of goods only and in detail within each invoice and without showing any accounting entry.All transactions except for goods: it shows us entries movements from discounts, payments, and transfers…etc. without taking the goods into consideration, and taking into account the dates of entries and other non-material transactions.The purpose of these four previous options is to facilitate the auditing of the accounts and match them, for example when we are matching with a customer if we choose the statement on the basis of showing all transactions except for goods, we can easily match payments and discounts and as a second stage we can choose goods transactions only to match it.The show options:- Material number: In order to show the card number of each material contained in the statement.

– Invoice number: In order to show the number of each invoice in the statement and link it with its materials so that it is a quick reference as this invoice contains only items listed below it (increase in the clarification).

– Invoices shortcut: we’ve already mentioned that to use invoices shortcut feature, you must put the mark (*) In the first note field on the invoice.

This would show us the name of the invoice and its value only though we chose the type of statement is illustrative, and the other invoices that we did not place a mark (*) it will appear in full detail.

– Show quantity: the quantity of each item appears next to its name in the statement.

– Price: the price of each item appears next to its name in the statement based on the price recorded in the Invoice.

– Show unit: which specified in the card as the default unit.

– Show invoice total: the bottom of each invoice shows a total value and this makes it easier to distinguish invoices from each other.

– Balance movement: to show the balance value, and its nature debit or credit after each transaction on the account, and no matter what the transaction is.

This makes it easier to match the account faster.

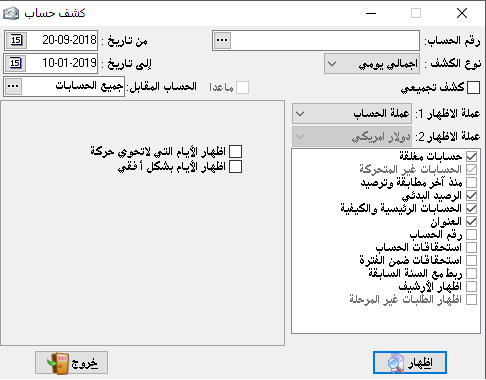

Gross statement:

Here we do not see any details in the account but only the account number, account name, and current balance without clarifying any transaction, and when we choose the gross statement, we take advantage of it to print a list of sub-accounts balances, for example, if we choose a gross customers account we will have a list of all customers’ balances together and each customer with his balance next to his name

Gaily gross statement:

It shows us the current balance of the account in the same previous show but for each day separately during the selected period. We have a choice that appears when we choose this type of statement and it shows the days that do not contain a transaction.

5- Monthly gross statement: the same as daily gross statement, but it is for every month.

– Along with all of these options, we can see two options:

– The show currency 1: it is fixed with all types of statements where we can show the account statement in two currencies whether the transactions are completed in the Syrian pound or in any other currency.

Where the program calculates each transaction based on the selected currency and the equivalent average rate on the date of this transaction.

And for transactions in the selected currency will remain on the basis of the actual rate we have recorded, in addition to the possibility of showing each transaction in the currency in which it was posted and the other show currency is any currency we choose.

This would benefit us in matching with our banks abroad or with our overseas customers, especially since we are often accountable to them for transactions in their local currencies (or as agreed).

The differences that resulted from using different currencies will be explained in a later section.

– The show currency 2: it is similar to the show currency 1.

– The opposite account: It is the second party of the entry, whether the entry related to an invoice or not. It is mainly useful in knowing transactions between customers, like show a certain amount has received from a customer to cover a debt to another supplier.

It is also used to show special discounts. We, therefore, take advantage of this option to find an account statement that shows a relationship between two specific accounts.

For example sales account and for cash sales, we put the account number at the top of the sales account and the opposite account is the cash account (or bank).

This will isolate sales that have been made in cash immediately from deferred sales, that when we are using one account for sales and without dividing accounts between sales to cash and deferred.

We can apply this case on many other cases and accounts that facilitate the work while maintaining the same results.

Special balances:

We have already mentioned the special balances and how its use would facilitate the linking of some accounts with each other which have the same properties, for example, customers of a particular region, specific material customers, or a particular group of materials.

or clients in a particular currency or customers for whom a specific employee is responsible, like if he was committed to pursuing the collection and delivery to that customer group only.

We can name these accounts as we want, and we have nine balances that we find in the miscellaneous section, then the program constants, and then the general constants.

Where we can add a list name at any time, when we specify the number of balances is three we see that three lines have been created to write the names of these balances.

And after naming we save it.And then if we go to the account card we find that these balances are included in the card and from this, we know that to link a particular account to a particular balance, we must place a mark on its card near the name of the balance which we want.

And suppose that we named (Northern customers) and customer number 1 from this area so we go to his account card and put the mark in front of the customers of the northern region and so for the rest of the accounts.

To use this feature, we go to the balances section and then the special balances showing all the balances entered by us in addition to the account balances section.

– List name: it is the list we choose based on our previous knowledge about its classification.

– Account number: it is only activated in the account balance, and will be explained later.

– Account type:We have three options:Show debit and credit accounts.

Show only debit accounts.

Show only credit accounts.

– The date of the last payment: here we determine the date we want.

And its purpose is to know whether this customer has paid us or we paid to him since that date or not, to determine whether his claim is valid now or not.

– The date of the last payment from: it is to clarify whether or not the movement of goods has been carried out since that date, to determine whether his claim is valid now or not (for example).

– Invoice type: it is determined to link it to the previous section and it, of course, determined by the nature of the client’s account.

– The debit balance is greater than: as the primary purpose of the special balances is to determine the appropriate time or use it as a reminder to claim payments or reminder of payment due to suppliers.

We may have clients whose balance is not too big and it is not tacted to ask them for payment (this is for personal discretion).

From this section, we can select a certain amount for the debit account so each customer above this amount will be asked for payment and so on.

– The credit balance is greater than: same as the previous paragraph with other terms.If we choose the name of the list account balance and here we have neglected the link we have made between the accounts through the special balances.

And we asked to show the same options but for a particular master account, where a sub-account cannot be used here, and the first benefit is that there may be a creditor customer in one of these lists which we named and so if we ask to show this list and only the debit accounts, this account will not appear either if we take account balance of the total accounts of the customers, it will appear with credit and debit balance.

It also benefit when we increase the number of special balances, we have 9 balances where we define qualitative accounts to link it to the accounts that we want and then ask from the special balances section the account balance (the desired qualitative account) and therefore we can obtain an unspecified number of special balances

Trial balance:

This item is mainly required in order to compare debit and credit balances, i.e. between customers, suppliers, expenses, and revenues to estimate the financial position. The trial balance is very necessary at certain periodic intervals, which may be daily, weekly or monthly. And according to the responsible accountant, it shows the financial tie in the organization. Including expenses and revenues, this is the main difference from the balance sheet as it does not show the expenses and revenues, and we can take the trial balance for all accounts when we do not specify a number for the account and we may take it to a particular primary account, secondary account or sub-account.

It is very important to estimate the size of the development in the accounts with different classifications, for example, a monthly trial balance showing us the increase or decrease in expenses and revenues…etc

The trial balance replaces the balance sheet when we take it at short periods for a week or a month…

– Scope of the show: it means we can depend on the date of the entry during the selected period of the show or on the numbers of these entries, there may be a specific entry number dated in an earlier period. We do not want to show all the accounts include in this period.

– The show currency: we can choose the currency in which we want to show the trial balance, which we have already entered it from a miscellaneous section and then currencies.

– The show levevl:

If the level is (0) it means to show all accounts.

If the level is (1) it means to show primary accounts only.

If the level is (2) it means to show the accounts which its code consist of two number or less.

If the level is (3) it means to show the accounts which its code consist of three number or less.

– Show fields:

– Account number: it is the account number that is required to show.

– Show subtotals: it will show a special field for debit total and credit total, and it is the totals of all transactions that took place during the month.

– Show first period balance: it means the balance that was the day before the selected day.

– The show options:

– Show sub-accounts: which are sub-accounts of the sub-accounts.

– Show closed accounts: the accounts with zero balance.

– Show moving accounts: This option is prepared if we activated the closed accounts option and if we do not, we can choose it or not and it is used only to show the accounts that have been moved or have a previous balance.

– Include the opening balance: it means adding the opening balance to transactions and showing the final balance.

Closing accounts:

The closing accounts are the final result of business operations that took place during the financial cycle as it reflects the outcome of the business during the period.

The special here is that we do not need to create these accounts, but it composed and organized automatically and based on prior identification of the card of each account of the posting section.

Where we find some accounts are posted to the operating account which related to industrial processes and accounts posted to the trading account.

And profits and losses…etc.

Operating account:

If we take the operating account impartially or imagine that we are dealing with it manually we find that what is included in this account is only related to raw materials, direct industrial expenses and accounts of the movement of raw materials.

All accounts and transactions related to the industrial activity are included in the operating account and this means that it has nothing to do with the business, administrative and financial matters of the organization. From this, we conclude that the operating account shows us the cost of the goods produced.

And of course, this concerns the industrial program for plants and workshops However, it can be used in Al-Edari program if we wish to control an uncomplicated industrial process. The accounts which should be closed in the operating account we should choose where to close it in its card.

The logical sequencing of the cost of the products requires that this price, which represents the balance of the operating account, be posted to the trading account. This is done automatically and without the need to write a particular accounting entry or open special accounts to close the operating account balance in the trading account

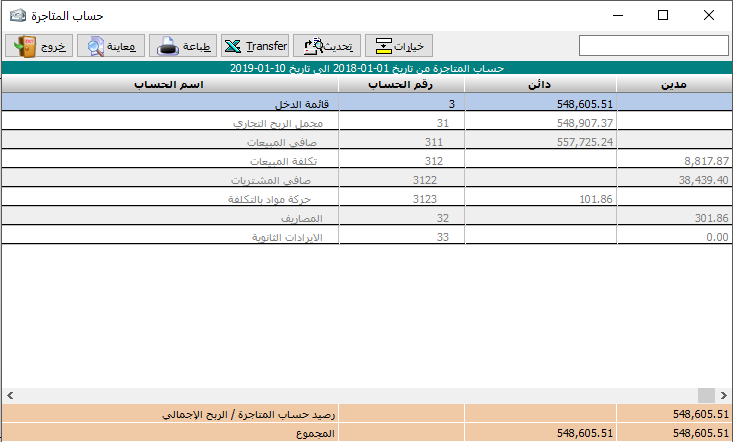

Trading account:

The first number in the trading account is the balance of the operating account that represents the cost of the products, if we are in an industrial facility and we use the operating account.

The underlying accounts that are included are all accounts and transactions on the finished goods, including all procurement expenses (as per the French method of accounting).

But we are in the proposed chart of accounts with the program we relied on listing the transactions of the goods ready for sale only and we left the purchase expenses to be included in the profit and loss account. And the best way for it is back to the owner of the organization or the investor of the program.Thus, we find here the accounts of purchases, their returns, the sales account and their returns and the account of the remaining finished goods at the end of the period, and finally shows the balance of the trading account which is either total trading loss or total trading profit and then it is posted to profit and loss account As a logical result of the closing sequence.

Profit or loss account:

The first number to be found in this account is the balance of the trading account, whether total profit or total loss.

We then find the accounts relating to expenses and revenues.

Whatever the type of these expenses and revenues, and of course should not be related to manufacturing or raw materials, for example, salaries, wages, transportation expenses, shipping and clearance expenses, administrative expenses, electricity, water, telephone, etc.

In the profit or loss account, all expenses incurred in the organization are subtracted from gross profit or loss, and all revenue is added to this total to result in our net profit or net loss, which is transferred to the final balance sheet and without the need for a special entry.

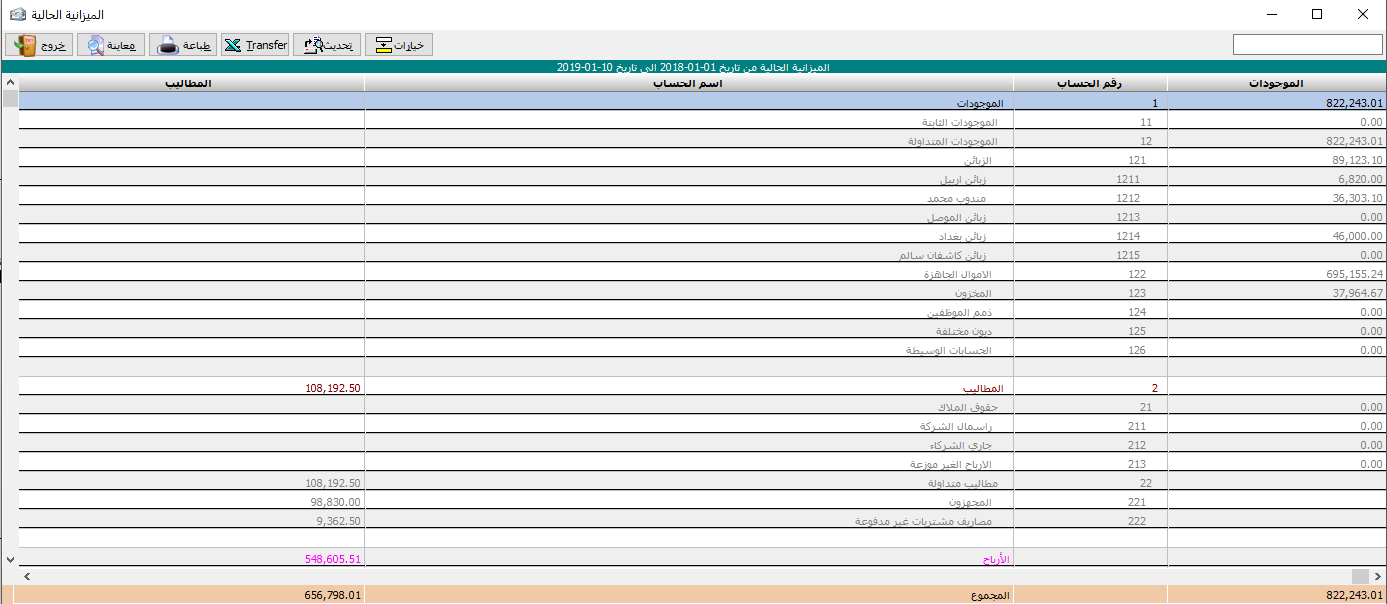

Current balance sheet:

It is the same as the final balance sheet if we request to show it at the end of the current period. The balance sheet shows all the assets and liabilities, i.e. all rights and obligations, from fixed current assets, goods, cash, trade receivables, trade payables, loans, capital, depreciation allowances, and net profit or loss. Of course, the current or final balance sheet must always be balanced.

Unless there is an imbalance in the opening budget. In Al-Edari program we can get a general balance sheet every moment and after every transaction, if we want to.

The balance sheet, in general, clarifies the financial position of the company as the result of differentiation between the assets and liabilities if the assets appear more than liabilities, it means that the financial position of the company is good, and thus it is in a profit position, or if the opposite it is in loss position.

All figures appearing in the balance sheet are balances for the accounts that the balance sheet configured from.

As a result of business operations during the year, it is the final conclusion of the work.

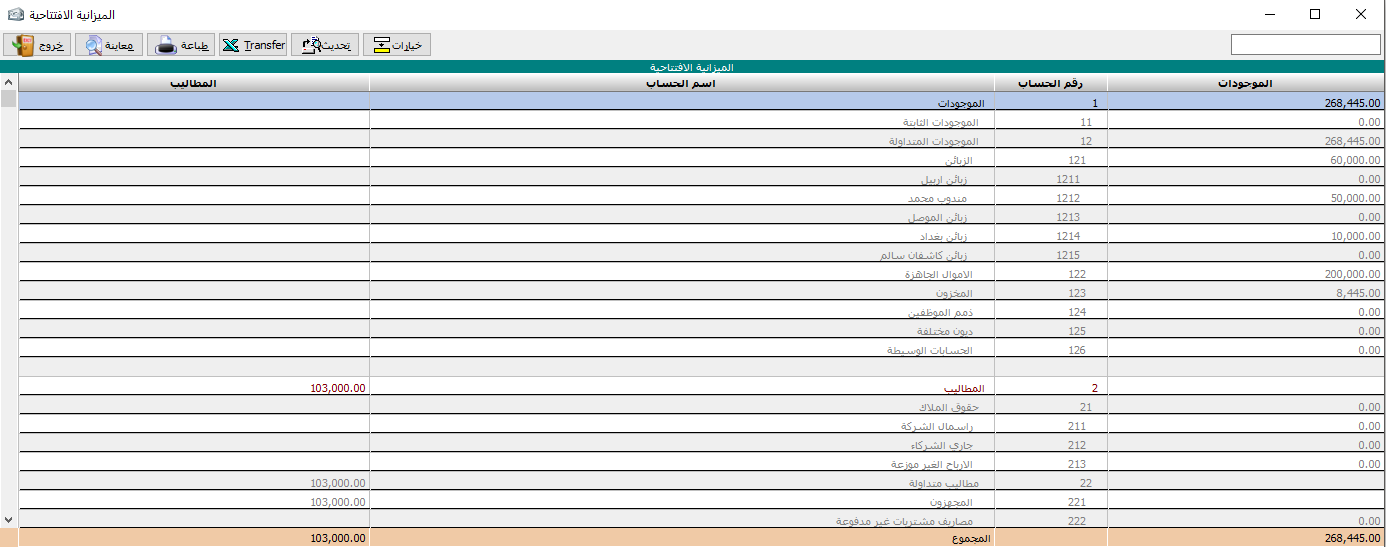

Opening balance sheet:

This balance sheet consists of the rounded balances of accounts and the balance of the warehouse from last year.

We can prove this balance either through the rounded balance field on each account card or by typing the opening entry.

Of course, if there is an imbalance in the opening balance sheet, it means that the imbalance will continue to the end of the financial period.

And means that our final accounts and results are inaccurate.

The opening balance sheet is the basis on which we will pursue our work.

– The blank rectangle next to the closing accounts is used to extract a closing account for a particular master account where we can make a balance for this master account independently of other accounts.* Show:

– Sub-accounts: it means showing or not showing sub-accounts.Sub-totals: it means showing or not showing totals of sub-accounts.Closed accounts: it means showing or not showing accounts with zero balance.

From date to date: Here we can specify a specific date for the final account to be shown, so, for example, we can know the amount of profits that have been made within a month. Or we can know the financial position within one month or one week only (for example).

The show level: To which level of the account number will appear in the balance sheet. If we choose number 4, all accounts whose number consists of 4 digits or less will appear. And each account that increases the number of digits of its card number from the four does not appear in the balance sheet.

Hide level 1: This means not showing primary accounts, which its account number consists of one digit only.

Then we press the button to show the desired closing account according to the options chosen previously.a

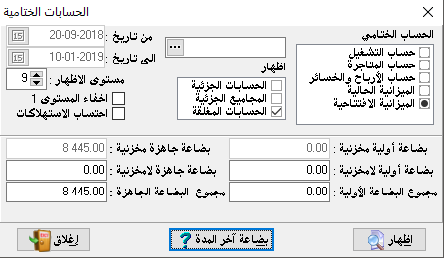

End period inventory:

This button shows us the balances of the goods as reported in the warehouses and with the figures to be reflected in the final calculations.

– Raw materials inventory: means the value of raw materials or materials for the manufacturing process.

– Raw materials non-inventory: The value of the raw materials non-inventory which are specified in their cards its type non-inventory.

And here if we have such materials, the program must calculate their value and place them in the designated location.

To be taken into account when calculating warehouse balance and therefore profit and loss.- The sum of raw materials: it is the sum of raw materials inventory and raw materials non-inventroy and it is calculated automatically.

– Finished goods inventory: it is the value of ready to sell goods and it is calculated automatically from warehouse balance.

– Finished goods non-inventory: it is for trading goods but non-inventory, so its value must be known and inserted in a specific field to be considered by preparing financial statements and calculated profit or loss.

– The sum of finished goods: it is the sum of finished goods inventory and non inventory and it is calculated automatically.

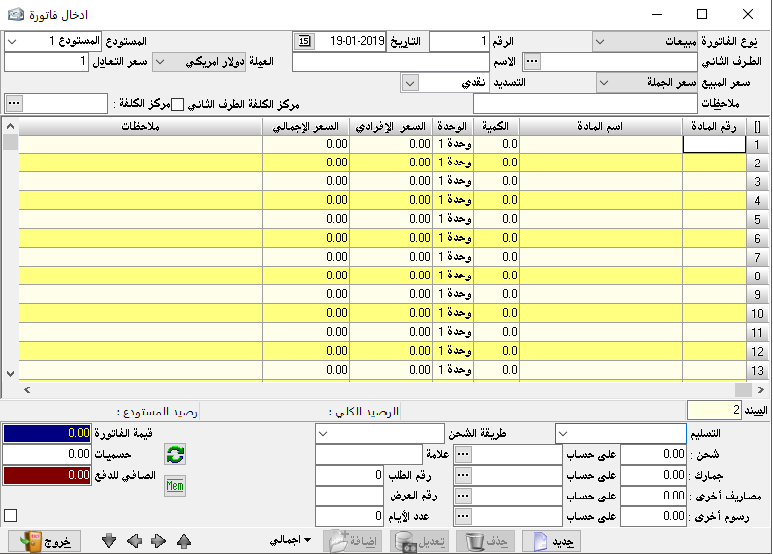

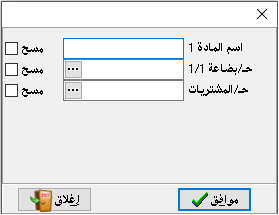

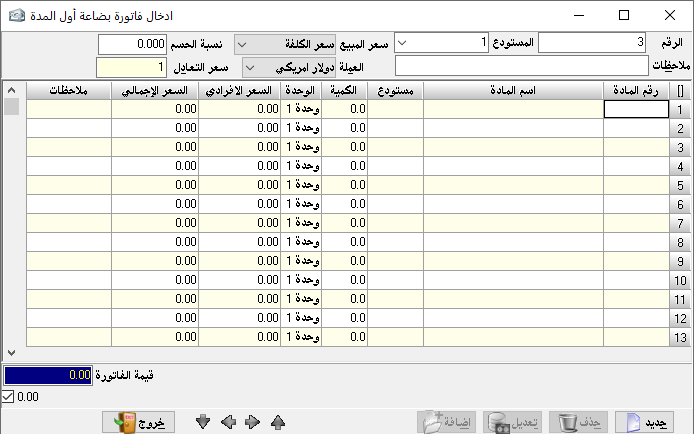

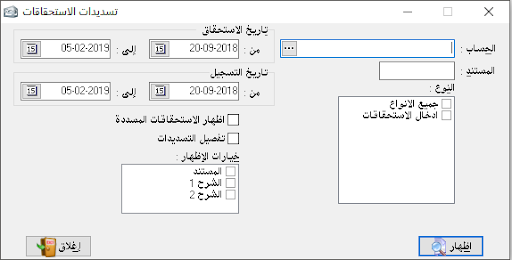

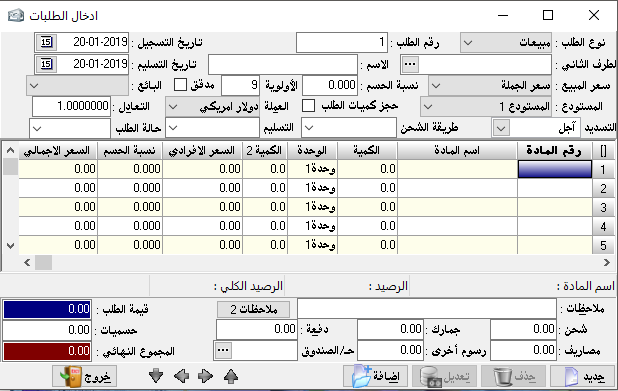

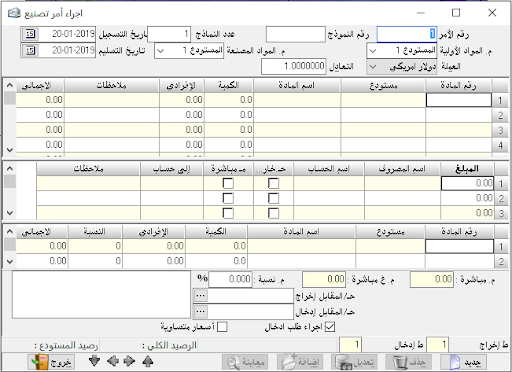

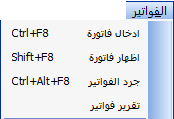

Create invoice:

to enter materials movements, go to invoices and then create an invoice.

Invoice type: and here we have the following types:

1- Purchase invoice: it is used to prove goods procured from suppliers to warehouses.Purchase return invoice: it is used when we return goods to suppliers.

Sales invoice: it is used to prove sales and goods transfer from the warehouse to the customer.

Sales return invoice: it is used to prove the process of returning the sold goods from the customers.

Input: its main use in workshops and factories to prove the input of manufactured goods from the production line to finished goods warehouse, or to correct the inventory.Output: such as input is used to prove the output of raw materials from raw materials warehouse to the production line for manufacturing, or to correct the inventory as well.

Transfer: we find it only if we have more than one warehouse, and this is determined by the program constants and general constants. Invoice number: we can set the invoice number manually and we can leave it automatically, or we can specify a special number. Also, we can specify a number for the billing notebook and list the numbers of its invoices for each individual notebook.- Date: it is determined by the transaction date.

– The second party: it is the name of the account you are dealing with based on invoice type. If the transaction is in deferral, we will mention the name of the client, and if it is in cash, we will mention the name and number of the cash account.

In all types of invoices, the other is the second party.

– Name: it is not linked to the accounting process, but for a statistical purpose to clarify the name of the recipient.

– The warehouse: it is used to determine the location of goods, if used here means that all goods included in the invoice are located in the same warehouse.

– Discount ratio: it is the discount ratio allowed to each item in the invoice, and is based on the predetermined rate of the item on its card.

– Sales price: we have noticed in the material card several prices for sale, and here is the actual use of it, where we determine the price we use for each customer to create invoices based on it.

– Notes: it is mainly used if we choose the automatically numbering, so we can mention here the number of the original paper document in order to link the paper document to what is recorded in the program or invoice number in the program.

– Material number: of course, it is not assumed to remember or know the numbers of all material cards because it is difficult.

So, we can query the item number by pressing F2 where the search window appears in the number or name, we type part of the item name may be three characters it is enough.

Then we choose the appropriate search method, press OK, the required material appears and then press OK so the number, name, and predetermined price appears, and so for the rest of the materials.And you can search for the item in another way.

Go to the item name section in the invoice and type part of its name and then press ENTER or F3 to show the required item.

– Material name: it is not possible to write in it unless we request it from the constants of the program, we can go to invoice format and then modify the name of the item.

– Quantity: it is the quantity sold or purchased based on the transaction, and we can note when the indicator is standing on it, it will appear at the bottom of the invoice the balance of the item in the warehouse, and this is useful to know the possible use of the item.

– Price: it automatically appears based on its previous selections.- Total price: the result of multiplying the quantity by the individual price.

And we can input the total price and the quantity so the individual price will appear immediately.

(Note: when the price appears in the invoice this does not mean that we are obligated to use this price, but can be adjusted as needed and directly)We can note in the table corner in the invoice, next to the material number, a rectangle.

if we double-click it additional options on the invoice will appear. And those options as follows:

– Distributor: it means the account of the person who sold the invoice in case we adopted the commission method for distributors. And we should mention his account number in the chart of accounts.

– Item discount ratio: when we activate it, the total discount ratio at the top of the invoice will be canceled, and a new column will appear in the invoice that is a specific discount for each item.

– Salesman: he is not the distributor, the salesman is the one who performs the sale inside the shop or the company, so the commission of distributor calculated based on sales and collections, while the commission of the salesman based on sales done because most of them are in cash. And in the end, it is due to the internal policies system of the company.

– Warehouse: when we activate it, the effect of the warehouse at the top of the invoice will be canceled, and a special column will appear where we can determine a specific warehouse for each item within the same invoice.

– The second and the third unit: it means selling items based on other units

. And here the program determines the quantity of the other units automatically after activating this option from the program constants in the section of invoice format.- Gifts: here comes a special column within the invoice to record free quantities obtained as a result of the purchase or granted at the time of sale. And it has its own accounting method.

– Discount ratio: it is not the discount ratio for all items that are placed on the invoice with a fixed rate for each item. But this can be determined for each item separately.

– Individual commission: there appears a special column within the invoice to register the commission granted to the distributor for each item.

And it can be different proportions from one item to another.

– Trading account: it is used when creating individual transaction accounts for each item. So, the entries for each item will be written based on specific calculations.

– Salesman: it is not the salesman at the top, where here a special column appears within the invoice to register the salesman in front of each item. And this allows registering one invoice with more than one salesman at a time.

– Length – width – quantity: it is specific to the businesses that sell goods counted on the basis of area. Such as carpenters and sellers of glass where the area of the material is determined (45.5*30*1) and equal to 1

.385 square meters of glass.

Then it is multiplied by the price of the square meter and so we will have the price of the goods sold.

– Tax: where the tax is calculated by a specific ratio on the invoice, and then placed in the chart of account as an accumulated tax account.

– Shipping company: it is used to link invoices always with the shipping company.

In case the shipment against the payment, the value will be transferred to the shipping company account.

At the bottom of the invoice, we find accounts necessary for the accounting adjustment of the invoice.

And it appears automatically after we select them from the primary accounts within the program constants.If the add section or new section is not activated, it means that the invoice accounts are not complete or there is an error.

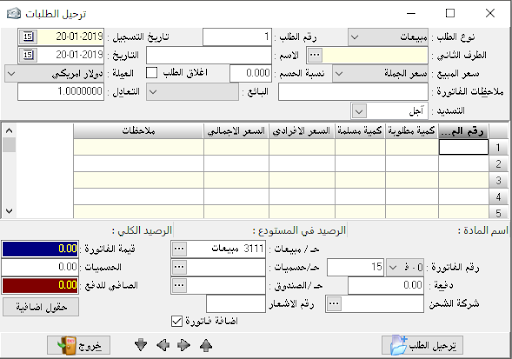

Additional fields button: shows us the following options, so the invoice will appear as follows:

Here we can find:

– Delivery: it means the method by which the content of the invoice will be delivered. Whether immediately, with the assistance of a person, or by a particular vehicle.

This section has no accounting linkage, but only for statistics.

– Shipping method: the way in which the goods are shipped by land, sea, or air shipping. And if it is against payment or not.

Also, this section has no accounting linkage, but only for statistics.

– Shipping, customs, and other fees: it is categories of extra charges on the invoice.

Where each one will be carried on the related account.

And in the end, it will be carried on goods to calculate costs accurately.

– Special mark: it is a special mark of goods in order to distinguish it.

And to ensure that it is not confused with another shipment at the time of shipping.

Or to distinguish it by the customer so that we can prove this mark of goods when we have an issue about it.

– Order number: here we place the order number under which the goods were ordered.

– Offer number: the offer number sent by us to the customer (for more assurance).

– New and add buttons: are used to save the invoice and going to a new one.- Edit button: it is used to make modifications on the invoice.

Where we request the invoice from the section of creating an invoice, and by the number and type we can access the invoice. And then we can make the necessary adjustment.

And after we finish we just press the edit button to save our modifications.

– Delete button: it is used to delete invoices.

And we can delete by pressing on the button delete from the section of entering invoices after opening the invoice according to its type and the same number.

Notes 2 section: to record more information and notes.

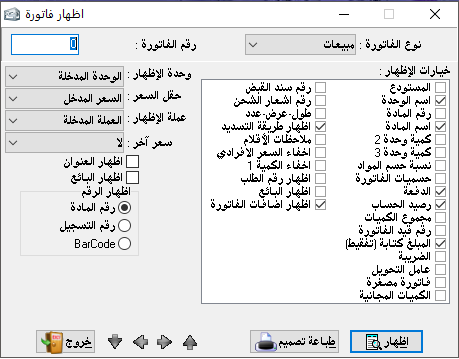

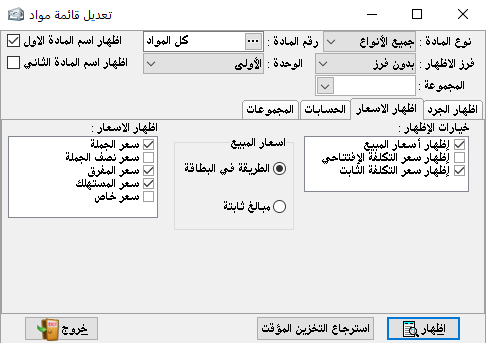

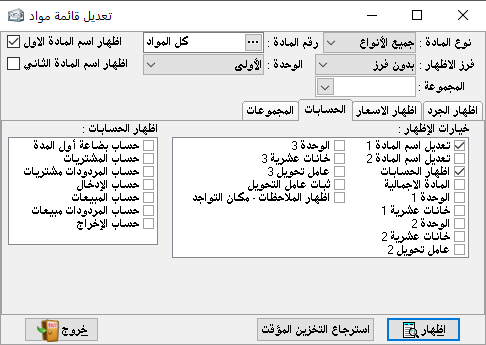

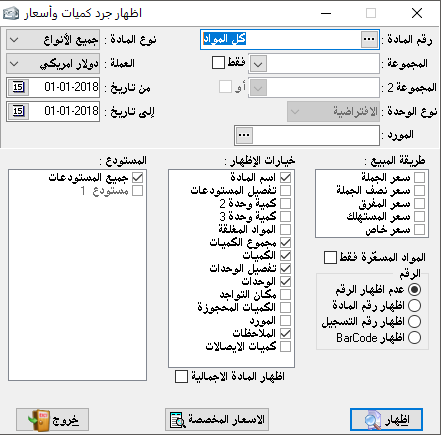

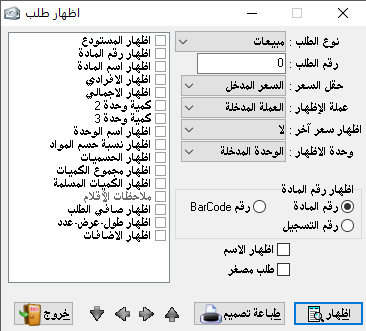

Show invoice:

It is used to view an invoice.

We have a lot of options to show, so we select the option we want, such as warehouse name, item name, or invoice number…etc- Unit of the show: as we found in the material card there are 3 units. We can show the invoice by the unit we want and also show it at the price we want which we have already specified in the material card (we can find here almost everything related to materials and requires proper preparation of the material card).

– The currency of the show: we can choose the currency in which we want to show the invoice provided that we have already entered the currency from entering currencies in the miscellaneous section.

– Another price: we can add another price to the invoice and it is of course based on our pre-identification in the material card.

– Show address: it means the address of the account holder whos the invoice produced to (the second party).- Show number: here we have the option to show the material number, registration number or barcode number.

– Design print: we can add our own printing form, where we can use it when we want and we are able to use the original form from the program.

– Warehouse: it is the warehouse from which the goods moved based on the invoice.

– Unit name: it is the sales unit like (Kilogram, Meter, Piece,…).- Material number: the material card number which included in the invoice.

– Material name: it is the name of the item.

– Quantity by unit 2: which is predetermined in the material card.

– Quantity by unit 3: which is predetermined in the material card.

– Materials discount ratio: if a discount is made to an item in the invoice, the ratio of this discount is shown here.

– Invoice discount: the total discount on the entire invoice, which is written at the bottom.- Payment: if payment was done and proved on the invoice.

– Account balance: the client’s account balance regarding this invoice.

– Sum of quantities: the sum of quantities of all items and even if types differed.

– Entry number of the invoice: it is the accounting entry number which automatically generated for this invoice.

– The amount in letters: invoice amount in letters like only one thousand and fifty dollars.- Tax: it is the tax amount deducted from the invoice value.- Conversion factor: means the conversion factor between the first, the second, and the third units.

– Mini invoice: this option requires to place the mark (*) at the beginning of the notes field in the invoice, where it appears to us in short form and without detailed items.

– Free quantities: it is the bonus which explained before.

– Receipt voucher number: if the invoice payment method is by bonds so it shows us the voucher number which generated for this invoice.

– Shipping notice number: it is the shipping notice number of the shipping company whether it was issued to us or from us.- Length, width, and quantity: this, of course, is different from the first quantity or unit, and it specializes in some special businesses. If the invoice was written in this way it will show us.

– Show payment method: while we can create our own payment methods (from program constants) it is very important that we indicate how the invoice will be paid when we request to show it for printing.

The four arrows at the bottom are each with a purpose that is indicated by the dialog box that appears when the mouse is pointing on it.

The first in order to go to the last invoice of the same type, the second to go to the next invoice, and the third to go to the first invoice of the same type mentioned at the top.Note: when we choose the type of invoice is transfer, we find that the show options have changed to fit the transfer invoice.

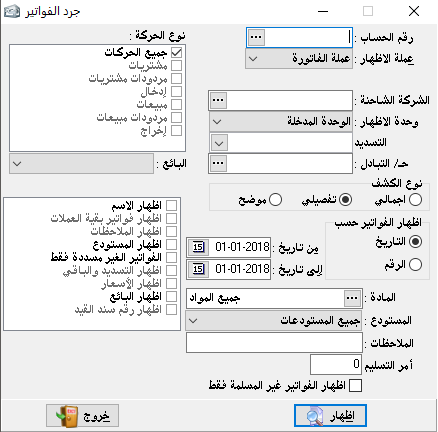

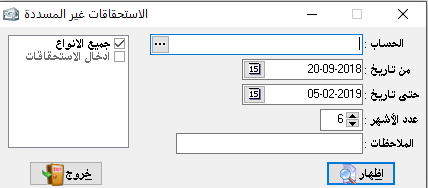

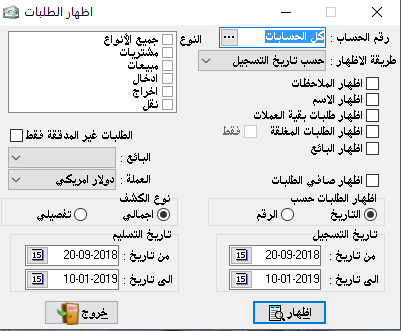

invoices review:

It is used to sort and match invoices with clients and by the type for a specific period.

– Account number: it means the name of the client.

We can choose the account of the total customers for example or the customers of a particular region, therefore we can put any major account here.

– The currency of the show: it means review invoices by the currency that we choose even if these invoices were not created by the primary currency.

– Shipping company: it means to show the company through which goods were shipped, of course, that after proving it when the invoice was created.

– The show form:

1- Total: it shows us invoices without details.

2- Detailed: it shows us the items of each invoice in addition to other required show options.- Show invoices by: number, or date.So from invoices review, we can find invoices of a particular customer, and by a particular type of invoices, or for various types, and in a specific date totally or detailed.

– Show name: it means the name that written in the invoice next to the second party.

– Show invoices by other currencies: when we choose to show at the top we choose a specific primary currency, therefore this option can show us invoices which not created by the primary currency.

– Show notes: the notes written in the invoice.

– Unpaid invoices: we’ve already talked about the paid invoices feature and this option will show us the outstanding invoices.

Show the payment and the rest amount: show paid amounts of the invoice and show the remain amounts which not paid yet.

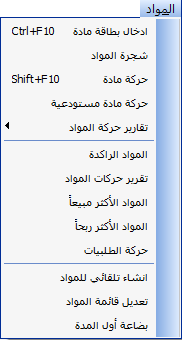

The second step in defining the program for our activity relates to the materials.

Where a card must be created for each material and whatever type (this can be determined depending on the nature of the project as we are talking about a normal trading business), and each card must take a certain number.

We go to the title of materials and then to the section of creating a material card to do so.

insert a material card:

This is where we define the materials and items that we are trading by, so each item must have its own card and each of these cards must have a number and name and specifications according to the following:Material number: which is the number of the material we want to insert and suppose for example it (001).

Material name: for example, men’s shirt model number (420), the second line is used to complete the item name or to mention the foreign name of the item.Notes: it is specific notes related to the material; it appears within inventory reports only.- Material type:

1- For trading: when its nature is for trading only, it was purchased to sell it only.

2- For manufacturing: when the item is a raw material and purchased to use it in the manufacturing process to convert it to trading material for sale.

3- Primary material: material containing several materials.

4- Primary material option: it is used for classification or building the chart of materials.

5 non-inventory:

a- without inventory control: used for materials that we don’t want to show in the accounting entries, and without a show of its quantity and value within the inventory. And here it never appears in the warehouse inventory.

b- with inventory control: when its quantity and value appear in inventory, but without accounting effect.Barcode: digital coding of materials (if the material has a code) and most of the materials and goods have barcode numbers.

And if they are not bearing the barcode, we can design barcode labels using Al-Edari, and the explanation will come in time.Registry number: used for low-quantity materials such as machines, which have a different production number than another machine.

It can be said that the registration number is the number of electrical products imported from abroad or the so-called order number.Classification number: our goods may have a specific classification that is linked to a particular sequence.Customs number: it is used if the goods are imported to link this material with its customs number.Group: it is used to allow the classification of materials into groups, which can be up to 3 groups.

And these three groups (or two of them only, or separately) can be linked to each other. The groups can be described from the section of constants within additional options.

Primary material: here we can dispense groups and make major primary material to include their sub-materials and arrange them in the chart of materials.

Level: it is used to identify the users who are allowed to deal with this material for trading or major use.

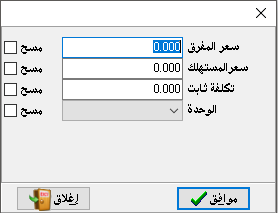

And in case of cancellation of a certain level, the material does not appear for this level either by query nor by reportsUnit: it is the way the material is sold by like (Kilogram, piece, bag, or bead…).

Decimal points: it is parts of the unit that the material sold or bought by, such as bag and a half (1.50) need to type two digits after the interval, (50 are decimal digits).

Unit 2: If there is another sale or purchase unit for the material such as (Ton, or bag).Decimal digits 2: Decimal parts of the second unit.

Conversion factor 2: it means how much is the first unit of the second unit (If the first unit is a kilogram and the second unit is a ton, the conversion factor is 1000, i.e. ton = 1000 kilograms).

If the first unit is larger than the second unit, we use division (The first unit is a ton and the second one is Kilogram 1/1000, the kilogram equals 0.001 tons).

Unit 3: same as unit 2.

Decimal Digits 3: same as decimal digits 2.

The conversion factor is always constant: it means if the conversion factor is always the same for the three units in a specific material.

Default unit: it means in which unit we depend as the basis for the equation among the three units.

Opening cost: material cost at the moment of transferring our data to the computer (the price depends on the default cost basis).

Fixed cost price: The price we choose as a default to calculate profit and losses on the basis of it, and without using the price of the average cost of the product.

Location: Statistically useful in knowing the location of the material in warehouses or on shelves without accounting linkage.

Minimum limit: it is the minimum limit of the material where it should not be beyond that limit in warehouses.

Maximum limit: it is the maximum limit of the material where it should not be above that limit in warehouses.Ordering quantity: Means the quantity for which a purchase order will be generated upon the arrival of this material at the minimum limit.

After we identify the supplier of this material on its card and once it reaches the minimum, a purchase order is generated from the same vendor.Supplier: here we mention the name of the supplier, who usually supplies us with this material.Gift: it means the bonus quantity which we claimed when we purchase in wholesale quantities such as medicines and cosmetics (every 12 pieces have 2 pieces for free).

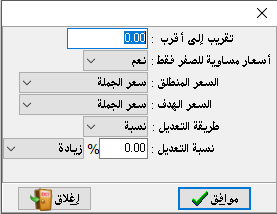

Sales prices: it is the way in which the sales price of the material is calculated, this price is calculated based on the cost of the selected material and appears on the invoice automatically and can be changed.

If we chose a fixed price, each of these prices must be specified by writing it and if the price is a ratio each profit ration must be specified. Here the program calculates the actual or current average cost of the material and then adds to the cost a certain profit rate as specified for each price and the result appears in the invoice.

Cost method: The method by which the program will calculate the cost of this material, for example, the average cost (which is best suited for most activities) calculates the prices of the material multiplied by the amount at each moment.

and of course, this cost is used to appear in the inventory and the available accounts, and to recalculate profit according to this cost and after each movement on this material.Rounded balances: This section is used to input the rounded balance of the material at the moment we take an inventory in order to transfer our data to the computer.

The quantity is multiplied by opening cost on the basis of the first unit and the output is placed in inventory in the opening balance sheet.

Where this value represents the opening inventory.

Accounts in the card are the accounts necessary to control the movement of the material.

In some projects such as hospitals, for example, each material may need to have their own sales accounts and purchase accounts that are different from the rest of the materials.

It is not required to put all accounts but it is required to put the end of period inventory account. Without it, the add and save sections will not be activated.

If we want to delete a specific card, we go to the section of inserting a material card and request the number of the card we want to delete it and then we press the delete button. And of course, we cannot delete a card with movement because we will waste those movements and this will cause a defect in our accounts. So, the deletion is not allowed when there is a presence of transactions.

Therefore, we should delete the transactions first and then delete the card.

For modifying, request the material card from the entry section and correct the card then make the required modification and press the edit button.

* When we finished entering the chart of accounts and entering the materials and their data, we have established our project correctly.

And we can start our business in practically.

With the assurance that the creating of the chart of accounts and the chart of materials must be accurate and completely correct because if the start of the program is correct, we can shorten the time and effort of the work later.After we have defined the chart and the materials, we must make the connection between accounting and warehouses.

And that is can be done with the movement of goods between customers and suppliers and this transaction is proven through the invoices exclusively and therefore any movement on the materials must be proven by invoice or otherwise will not bind with warehouses.

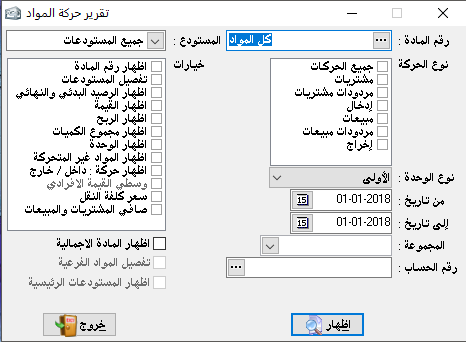

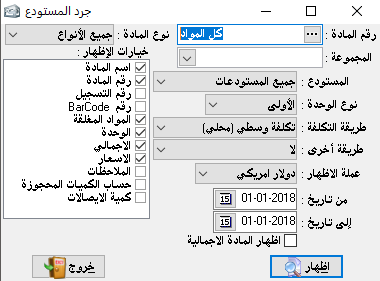

Material movement:

The main section of it was explained, but the graph show as follows:

The graph show:

It is to draw diagrams for the movement of certain materials within a specific time.

So that it is useful to compare this movement during the chosen period by another period in order to know the evolution if it is positive or negative.

In order to study marketing, financing, storage, and supply plans.

It gives a very clear picture of the movement and development of material which is useful in preparing studies for the marketing and supply of materials and determining the seasons and periods when we must invest more, or in some seasons we must transfer the investment to other materials.

This prevents the accumulation of goods in some seasons and transferring funds to invest in another field, higher profitability, and higher marketing capacity.

– Material number: We can choose two materials to appear together on the axes of the coordinates. Because there is no clear vision for more than two axes at one level.

If we choose more than two materials, all materials are combined and shown in aggregate.

– Transaction type: We can choose the transaction we want from the show options.

– Statement type:

1- Overall statement: for all materials, it shows the average movement of all materials and as one mass.2- Detailed statement: It fits a material or two at most for the reason mentioned earlier, and when we select more materials it turns into an overall show.

– Statement period:

1- Monthly statement: It chooses the average movement within each month individually and is presented as a movement of this month. And that if all materials are chosen.

2- Daily statement: It chooses the average movement within each day individually and is presented as a movement of this day. And that if all materials are chosen.

– Type of the show:1- Show quantities: where the show is numerical and according to the quantities of the selected materials.

2- Show prices: where the show is based on the amount that materials moved by.

– Warehouse: we can choose all warehouses or one warehouse only.

– Date: to limit what to show for a specific period, even for one day.

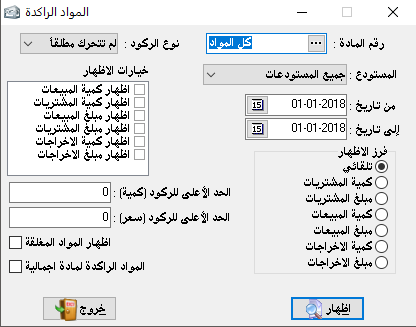

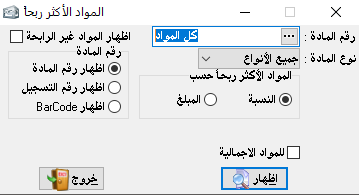

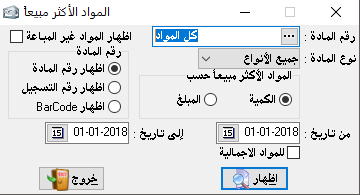

Stagnant materials:

It is useful to know which materials and goods are not sold in an encouraging way.

And of course, this is a relative matter for the investor, the material type, the season or period. So it’s back to the investor’s discretion, in the end, to consider if the material is stagnant or not.

And in order to make the right decision we have the following options:

– Material number: By querying F2, we can choose one material, a group of materials, or all materials.

– Type of Recession:

1- Never moved at all: materials didn’t move at all either by selling nor by buying.

2- Never moved by selling: and the other movements are not taken into consideration.

3- Never moved by purchasing: and the other movements are not taken into consideration.

4- Never moved out: it means materials never moved out to the production line if the company is an industrial or semi-industrial establishment.

– Date: the date is specified by the investor.

– Sort the show: the arrangement of materials:

1- Automatic sorting by the material number or by the method selected in the warehouse inventory arrangement.

2- By the quantity of purchases: they are arranged incrementally according to the quantity purchased.

3- By the amount of purchases: they are arranged incrementally according to the amount of purchases.